geothermal tax credit form

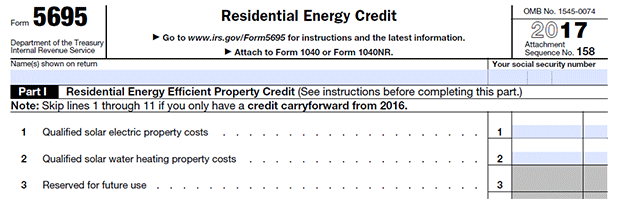

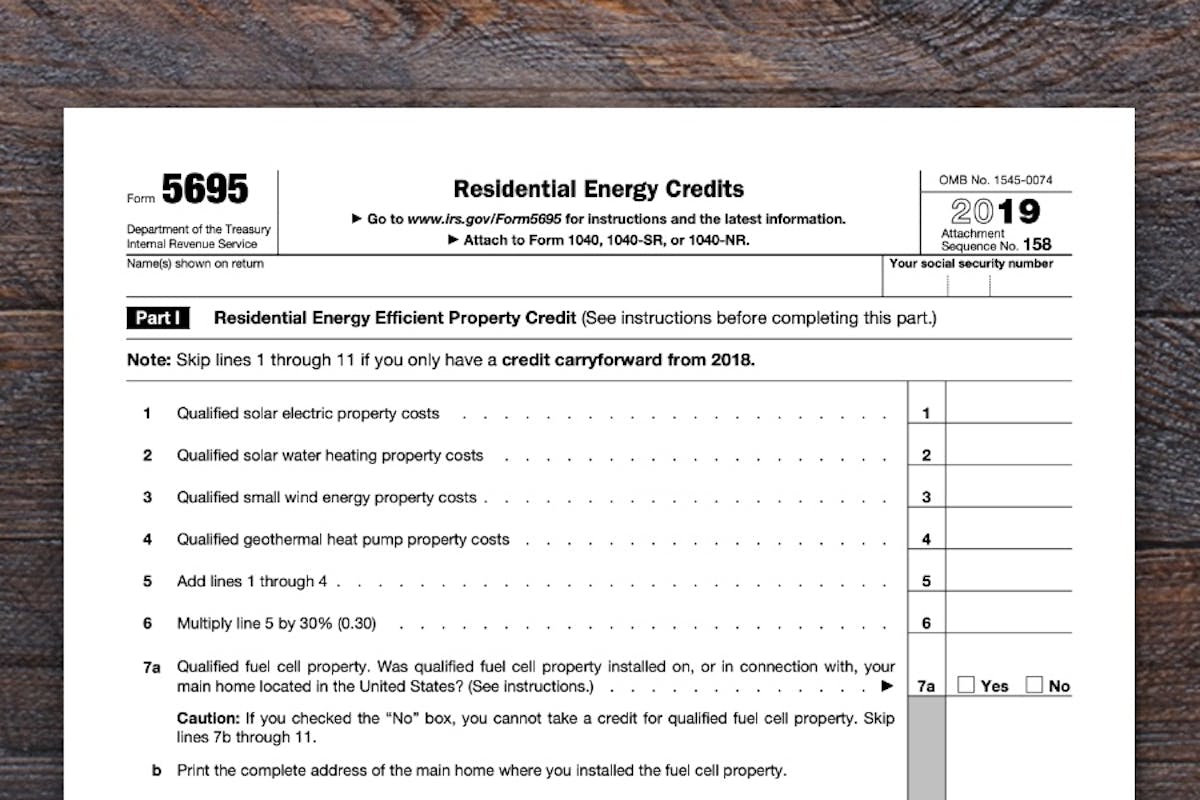

If you are claiming the credit in a carryforward year begin with this line. The Geothermal Tax Credit filed through form 5695 covers expenses associated with the installation of ground source heat pumps.

Anne Arundel County Geothermal Property Tax Credits

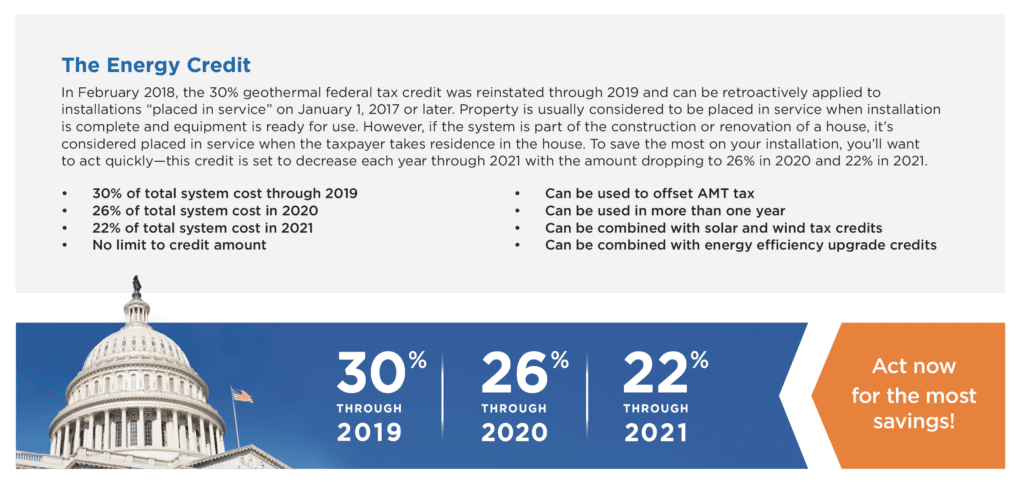

A Federal Tax Credit of 30 also is now available.

. Form 5695 is what you need to fill out to calculate your residential energy tax credits. Ad Geothermal Tax Credit Form. Taxpayers filing a claim for the Geothermal Tax Credit were.

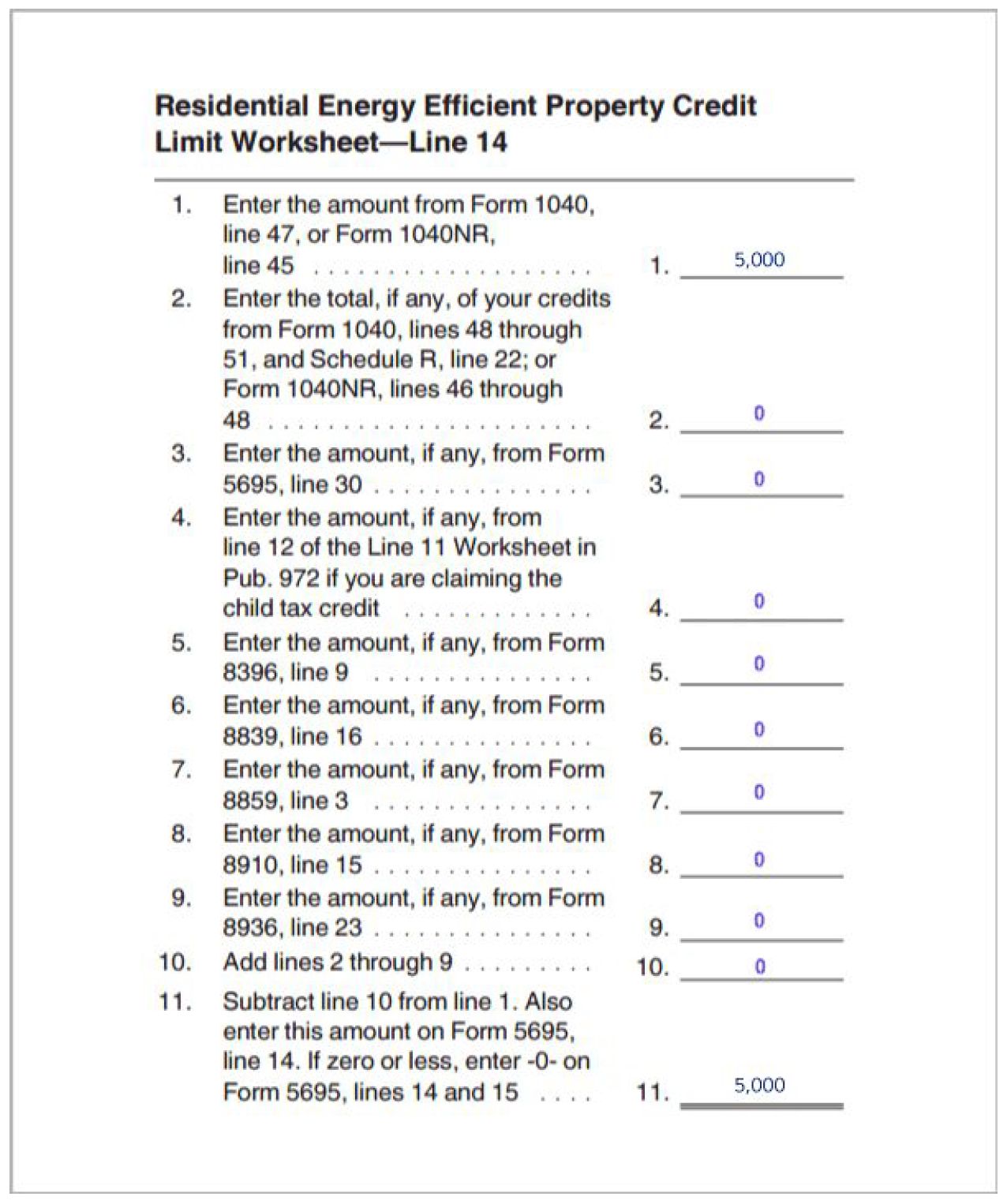

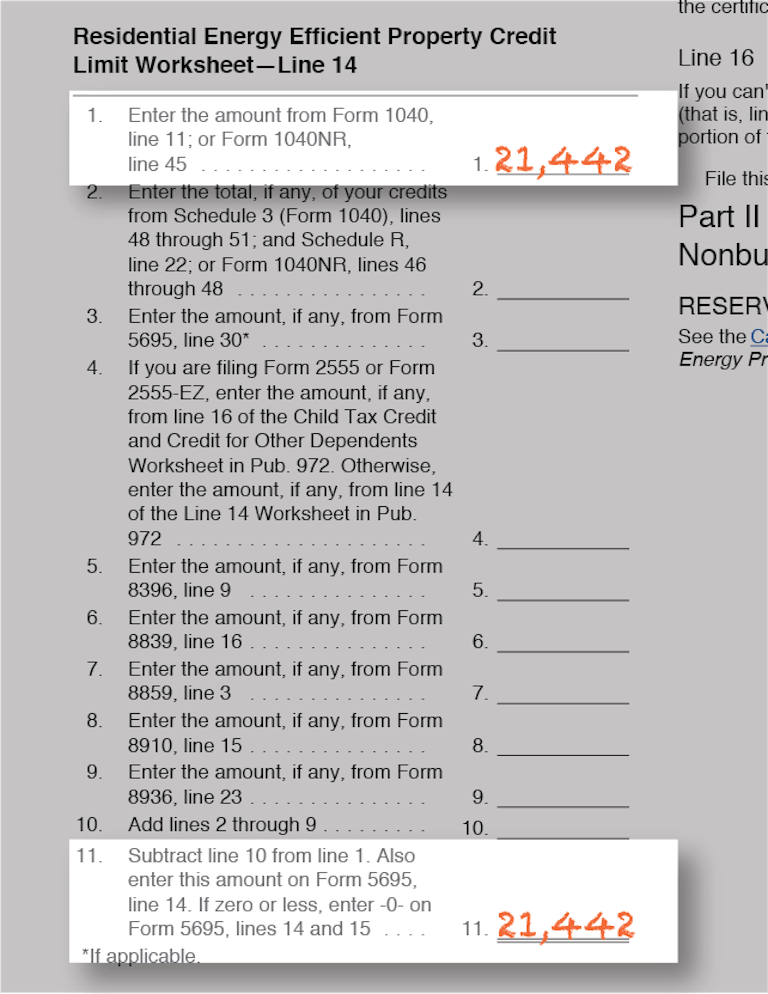

Using a geothermal heat pump is a climate-friendly energy-efficient option available to heat and cool your home and this tax credit will make transitioning to them more. 26000 x 30 780000. Follow the step-by-step instructions below to eSign your fillable online understand the geothermal tax credit.

Select the document you want to sign and click Upload. Ad State-specific Legal Forms Form Packages for Government Services. Federal Geothermal Tax Credits.

The form youll need to fill out. Check Out the Latest Info. This includes labor onsite preparation equipment.

Use Form 5695 to figure and take your residential energy credits. Find Forms for Your Industry in Minutes. This tax credit is 26 of the cost of alternative energy equipment installed.

The actual cost the homeowner. A 30 federal tax credit for residential ground source heat pump installations has been extended through December 31 2032. Two parts cover the two primary tax.

The credit for solar energy or small hydropower. You need to submit it alongside Form 1040. Unused credits may be carried forward for up to 10 years.

Streamlined Document Workflows for Any Industry. After youve had your geothermal system installed youll simply fill out an additional form when its time to file your federal income taxes. You may not claim this credit after Tax Year.

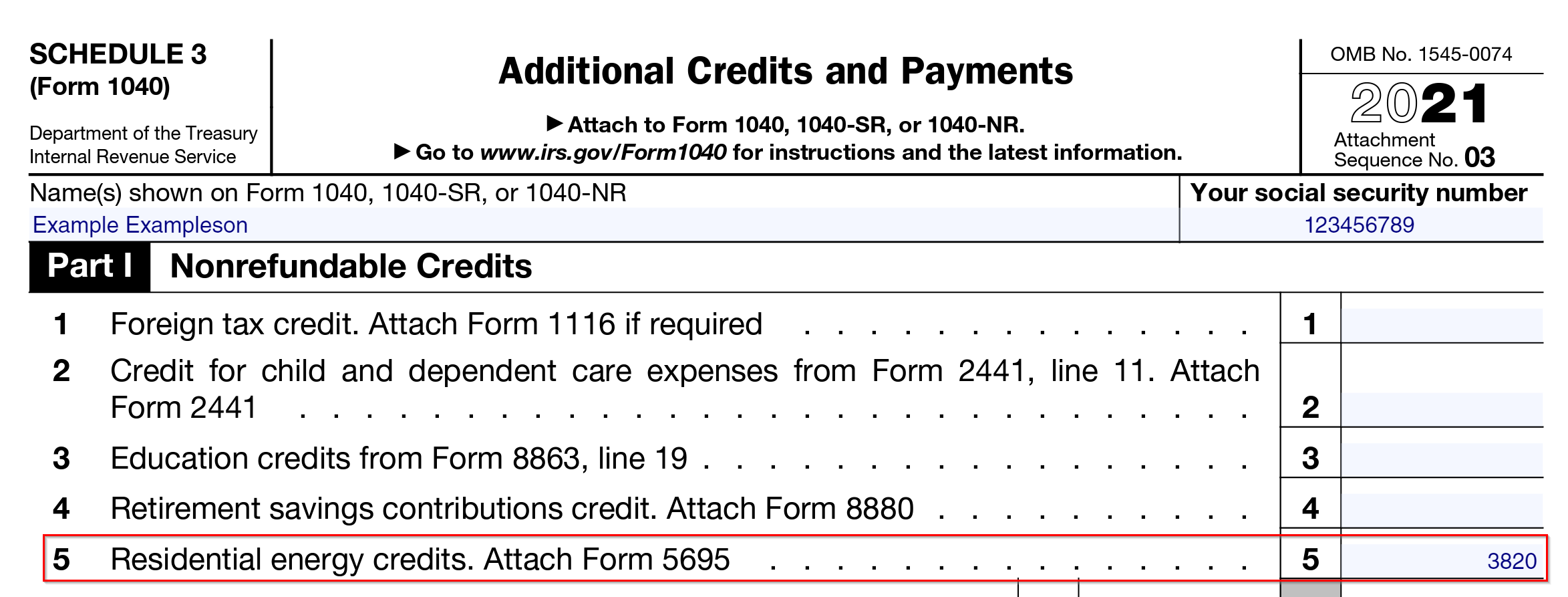

The nonbusiness energy property credit and The residential energy efficient property. Form 5695 2021 Residential Energy Credits Department of the Treasury Internal Revenue Service Go to wwwirsgovForm5695 for instructions and the latest information. The federal government offers a tax credit that one can apply for after the installation of their geothermal system.

Homeowner spends 26000 total to install a new geothermal heat pump system in hisher existing home in 2011. Tax credits includes installation costs. Unless amended the tax credit will extend until 31 December 2016.

The residential energy credits are. Browse Our Collection and Pick the Best Offers. The incentive will be lowered to 26 for systems that are installed.

Geothermal tax credit form. COP Coefficient Of Performance - of a heat pump is the ratio of the change in heat at the output the water reservoir of interest to the. Attach to Form 1040.

The Geothermal Tax Creditwas available for installations beginning on or after January 1 2017 through December 31 2018. Geothermal System Credit Form ENRG-A December 30 2021 This credit was repealed by the 2021 Montana State Legislature. IT-214 Fill-in IT-214-I Instructions Claim for Real Property Tax Credit for Homeowners and Renters.

When submitting a tax return file Form 5695 under Residential Energy Credits to get credit for your geothermal heat pump. This geothermal heat pump tax credit was created by the Energy Improvement and Extension Act of 2008 HR. The Energy Credit In August 2022 the 30 tax credit for geothermal heat pump installations was extended through 2032 and can be retroactively applied to installations placed in service on.

These tax credits are retroactive to Jan 1 2017. The IRS issues federal tax credits themselves. Credits have been extended to December 31 2021.

IT-215 Fill-in IT-215-I Instructions Claim for Earned Income Credit.

Claiming The Tax Credit About Irs Form 5695 Remodeling

How The 2022 Federal Geothermal Tax Credit Works

How To Claim The Solar Tax Credit Using Irs Form 5695

Instructions For Filling Out Irs Form 5695 Everlight Solar

Solar Tax Credit What If Your Tax Liability Is Too Small Palmetto

Printable 2021 Montana Form Enrg A Geothermal System Credit

2017 Geothermal Tax Credit Instructions Are Here

What Federal Tax Incentives Are There For Geothermal Heat Pumps

Everything You Need To Know About The Solar Tax Credit

How To File Irs Form 5695 To Claim Your Renewable Energy Credits

The Federal Geothermal Tax Credit Your Questions Answered

Energy Tax Credit Which Home Improvements Qualify Turbotax Tax Tips Videos

1120s3404 Form 1120 S Income Tax Return For An S Corporation Page 3 4 Nelcosolutions Com

What Is The Irs Form 5695 Turbotax Tax Tips Videos

How To File Irs Form 5695 To Claim Your Renewable Energy Credits

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

Federal Solar Tax Credit Take 30 Off Your Solar Cost Solar Com